Understanding Easy Loans in the Digital Era

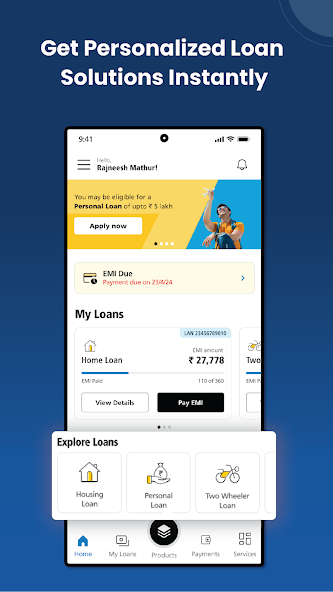

In today’s digital-first world, financial access has become simpler and more inclusive. Easy loans are one such solution that caters to individuals needing fast, uncomplicated funding without excessive documentation or extended processing times. When you explore the option to loan apply online, the entire borrowing experience becomes smoother and more accessible, especially for those managing urgent or personal expenses.

Online lending platforms have reshaped how borrowers interact with financial services. Whether you are a salaried employee, a small business owner, or someone dealing with temporary cash shortages, easy loans offer a quick way to meet financial demands without stepping into a bank branch or waiting in long queues.

What Are Easy Loans?

Easy loans are short-term or medium-term financial products that are available through digital platforms. They are often unsecured, meaning there’s no requirement to pledge assets or collateral. The primary focus is on the applicant’s ability to repay, verified through simple documents or digital verification.

These loans can be used for a variety of purposes—covering medical bills, education expenses, travel plans, emergency repairs, or simply bridging the gap between paydays. The ease of applying and faster disbursal process make them attractive to a wide demographic.

Benefits of Choosing Easy Loans Online

Fast Application Process

One of the most significant benefits of easy loans online is the application speed. Most platforms allow borrowers to complete the entire loan application process in a few minutes. By submitting personal details, income information, and identification digitally, users can bypass traditional paperwork, saving time and energy.

Minimal Documentation

Unlike conventional bank loans that require multiple rounds of paperwork, easy loans usually ask for minimal documentation. A valid ID, proof of income, and basic contact details are often sufficient. Some services even use automated systems to verify details using linked accounts or government databases, making the experience seamless.

Instant Approval and Disbursal

Online loan approval systems are automated and work around the clock. Once your application is submitted, algorithms process the information and provide a decision within minutes. Upon approval, the funds are credited directly into your bank account, often on the same day.

Accessibility for Various Income Groups

Another benefit of easy loans is their availability to a broader audience. Whether you are a freelancer, a gig worker, or someone without a long credit history, many lenders offer customized loans based on digital credit assessments. This opens doors for individuals who might otherwise be denied traditional credit.

Transparent Terms and Flexible Repayment

Digital lending platforms are designed to provide transparent information regarding interest rates, repayment schedules, late fees, and other conditions. Most easy loans also come with flexible repayment plans. Borrowers can select durations ranging from a few weeks to several months, depending on their ability to repay.

Secure and Private Transactions

Security is a priority in the online financial space. When you apply for easy loans online, your personal and financial data is encrypted and protected by multiple layers of cybersecurity. This ensures your details remain private and inaccessible to third parties.

Access from Anywhere

The convenience of digital access is unmatched. You can initiate a loan application process from your mobile device, laptop, or tablet—whether you’re at home, at work, or even traveling. This round-the-clock availability is especially useful during emergencies.

Common Uses of Easy Loans

Easy loans are not limited to emergency situations. They serve a wide range of purposes based on the borrower’s needs:

- Medical Expenses: Covering unexpected hospital bills or treatments.

- Home Repairs: Fixing electrical, plumbing, or structural issues quickly.

- Education Fees: Paying tuition or exam-related costs on short notice.

- Travel Plans: Managing last-minute travel or vacation costs.

- Debt Consolidation: Combining multiple smaller debts into a manageable single loan.

Such flexibility makes easy loans a preferred choice for many.

Factors to Consider Before You Loan Apply

While easy loans offer multiple benefits, it’s essential to borrow responsibly. Before applying, consider the following:

- Repayment Ability: Only borrow what you can repay within the chosen timeline.

- Interest Rates: Compare rates across platforms to avoid high-cost loans.

- Loan Tenure: Choose a tenure that matches your income flow.

- Lender Reputation: Check the credibility and customer reviews of the platform.

Borrowers should also read the full loan terms before accepting an offer, ensuring no hidden fees or unexpected clauses are present.

The Future of Easy Loans

With ongoing advancements in financial technology, the accessibility and scope of easy loans are expected to grow even further. Digital verification, AI-powered risk assessments, and real-time disbursals will continue to improve, providing faster and more reliable loan services for users from all walks of life.

In the coming years, more people are likely to prefer digital loans over traditional ones, owing to their convenience, simplicity, and speed. The future lies in financial solutions that are user-friendly and readily available—just like easy loans.

Conclusion

Easy loans have become a practical financial tool for those looking to manage short-term expenses without lengthy procedures or excessive paperwork. Their online availability makes them especially useful during emergencies or unplanned situations. Whether you’re dealing with a personal need or simply want faster access to credit, applying online simplifies the entire process.

Choosing to apply for easy loans online brings efficiency, speed, and control back to the borrower. With multiple benefits and minimal hassle, it’s clear why more individuals are turning to this modern solution for their financial needs.