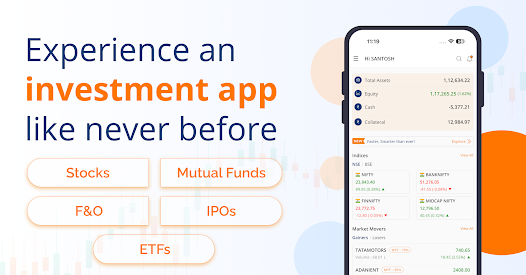

The rapid growth of finance and technology has made investing in the share market easier than ever. Nowadays, you can easily download any share market investment app and start investing in mutual funds at your fingertips. Doesn’t matter if you’re just starting or are an experienced investor; these apps can guide you at every step of your investment journey.

Making investments in mutual funds in India is a relatively low-risk and non-tricky business. Mutual funds accumulate money from multiple investors and then diversify that amount across stocks, shares, bonds, and other such assets. This is actually helpful for beginners who do not have much knowledge about how to invest in stocks or people who don’t have that much time to study and pick individual high-performing stocks.

However, there are some simple steps or key points that you can follow while trading in mutual funds using the latest investment apps:

- Selecting the right investment app:

The most important step before investing in mutual funds through an app is to select the right investment app that matches your investment goals and expected return. It is always advisable to select a share market investment app that offers maximum support, an easy KYC process, low or even zero-commission mutual fund options, multiple investment options (SIP or lump sum), comparisons between funds, etc.

HDFC mutual fund app is one of the best apps that will provide an investor with all of the best features and a range of mutual fund schemes. If somebody is just starting out with investing in mutual funds, then this app is the best option to opt for.

- Explore different types of mutual fund schemes:

Mutual funds in India have a wide range of schemes to offer. It’s always best to explore these and select the best scheme to invest your money in. You’ll see multiple options such as equity mutual funds, tax-saving ELSS funds, hybrid funds, debt mutual funds, etc. Browse through all of these schemes, compare their returns and rankings, and then decide which suits your investment goals the best.

- Start your trading journey:

Once you’ve explored all the schemes and decided what’s best for you, you can finally begin to trade in mutual funds. Now, there are two types of investments that you can make:

- SIP (Systematic Investment Plan): In this, you invest a fixed amount every month.

- Lump Sum: In this, you invest a large amount all at once.

- Track your investments

Once you have made your investment, its now time to systematically track it and modify it, if needed. There are many modern apps like 5paisa Capital that provide each customer with a unique dashboard to track their investment portfolio’s performance in real time. This helps you to manage your investment more effectively and make any changes if required.

Even though mutual funds in India are subject to market risks, they are still the safest option for investors to dive into. Plus, with the rapid growth of fintech, investing in mutual funds has now become easier than ever. Be it SIPs or lump sum investments; every scheme is designed to give you maximum returns at the lowest possible risk. It’s never too late or too confusing to start investing your money. Start today and let compounding work its magic!